Fortune 500 technology company

BFSI

USA

* for the purposes of anonymity we are using the pseudonym of National Fintech Services or NFS and its product as Digital Banking Suite.

When it comes to zeroing on a decisive competitive differentiator for financial software vendors around the globe, ‘Compelling Customer Experiences’, wins hands down. However, developing new experiences is not just about revamping the existing legacy applications or building a new experience from scratch—it is also about delivering them fast and fresh. To do so, financial software vendors need dependable tools in their development tool kit. In this customer story, we talk about how the right strategy and tools enabled our client to modernize its digital banking platform and provide them an edge over new-age competitors.

Director, Technology Strategy

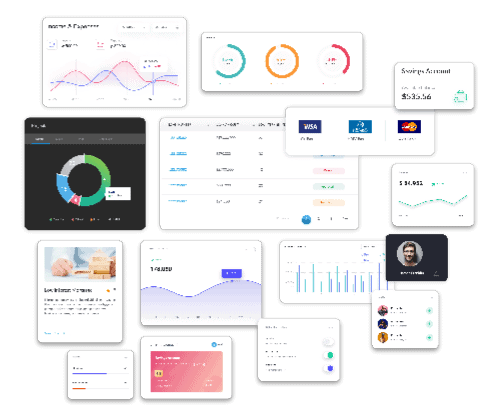

The Digital Banking Suite (DBS) is a set of solutions offered by NFS to its client banks. The DBS offers a customer-centric, personalized, omnichannel banking experience for end-users of client banks while providing consistency across digital and mobile self-service and banker-assisted channels. Built on a single integrated platform, it transforms the digital banking experience by providing continuous engagement across the enterprise with real-time access to customer, account, and transactional data.

The DBS platform was built on a rigid legacy system that did not support the development of modern experiences. To stay competitive with new-age fintech and provide modern user experiences, NFS had to modernize the existing platform. But traditional methods of modernization would lead to delayed GTM, and long people-heavy implementation cycles were restricting the growth of the platform. NFS needed to come up with a more viable modernization strategy–one that propels modernization but causes no interference with existing systems.

A composable architecture is one where applications are assembled together using reusable software components. Just like Lego blocks that can be retrofitted to create any kind of structure, reusable software components can be assembled together to compose applications. Our client strategically decided to move to a composable approach towards modernizing its experience layer on the DBS platform in what we call the “Modernization with Co-existence” model. This essentially consisted of two parallel processes:

To accelerate its modernization process, the client decided to use a low-code platform. After careful consideration and evaluation, NFS zeroed in on WaveMaker, having evaluated various well-known products in the low-code domain.

WaveMaker is a composable experience platform that can be used by developers to visually build applications at a rate faster than traditional hand-coding but without the trappings of lock-in and platform-specificity.

To achieve this, WaveMaker uses the concept of prefabs that are self-sustained, reusable components built over UI, business logic, and data. Prefabs can be further assembled to componentize end-to-end, multistep user journeys that can be plugged into WaveMaker applications.

Plug-and-play, multi-step, end-to-end user journeys assembled from multiple prefabs.

In this way, developer teams can create their own artifact repository which further acts as a component app store for implementation teams within their organization.

WaveMaker proved to be a hand-in-glove fit for NFS’s modernization efforts primarily because of the following reasons:

WaveMaker was integrated with DBS to create a low-code-based custom studio. This is a cloud-native studio that is agnostic of the core banking platform, which means that it could easily integrate with existing core banking applications using custom code. It offers diverse financial products, information dashboards, self-service, and third-party integrations to its customers.

The core development team used WaveMaker to build the platform as a composition of reusable components: a repository of easily consumable banking components built on top of internal and external APIs.

From basic widgets to prefabs to entire user journeys, the core team developed close to 75+ reusable components. In fact, the repository is growing at a steady rate to meet the demands of a dynamic market. Existing functionalities were incrementally replaced with WaveMaker-built components and new functionalities were added to the platform.

The implementation team working for specific banks pick and choose banking components from the component repository to compose customized applications and make use of navigation, themes, and styles and prefabs consistent to the bank.

All a WaveMaker professional developer has to do is open the project in a base shell, apply a custom theme, drag and drop prefabs and configure them to their requirements.

During this engagement, WaveMaker Professional Services were roped in to jumpstart our client’s modernization efforts. In the initial days, components were built by the PS team while NFS developers started learning the nitty-gritty of the low-code integrated studio. They took to the platform very quickly indicating a low learning curve for professional developers with diverse skill sets. Also, developers could work with the existing paradigm of development in terms of agile methodology and iterative development.

In fact, the core team now mainly consists of NFS developers and has transitioned to a self-sufficient model where some members can even claim to be WaveMaker SMEs.

The extensive adoption of the studio within NFS has prompted them to even set up a Center of Excellence (COE) for the low-code integrated platform that can now enable quicker onboarding of development teams.

Over a period of one year, NFS was able to create a rich repository of 75+ banking components in the studio. These components have been used to compose applications for more than 5 banks, with one bank going live in a short span of just one year. This kind of accelerated development has only been possible through the strategic use of a low-code based composable platform.

At the outset of this case study, we mentioned how the customer-experience landscape is forcing banks to take a relook at their digital offerings. NFS has a vision of enabling the development of deep personalizations for its client banks at an end-user level. The modernization of the DBS project was propelled by an experience-driven design. Tailor-made customizations, not just at the page or template level, but also based on the user persona such as goal-based widgets or widgets that are geared towards user activity in a consistent fashion were made possible by the studio.

UI personalizations such as the look and feel, dark vs light theme, placement of widgets, and color palettes would change based on the user profile.

These personalizations were not just limited to the UI level but also percolated down to the offerings. For instance, the products that are offered to a student are vastly different from the products that are offered to say an entrepreneur.

This ability to consume insight-driven APIs and customize the visual components over these APIs deeply changed the way customers experienced the application.

The studio’s capabilities to create visual components over APIs are not limited to internal APIs but extend to third-party APIs that are not natively available such as P2P payments and account aggregations.

This enabled NFS to componentize a variety of services, from insight-based experience APIs to data aggregation APIs. Modern client interaction workflows were componentized over the studio with integration to service experience APIs. Digital payment components were created by abstracting visual components over third-party APIs for fund transfer.

In short, the low-code integrated studio made it super easy for developers to consume and componentize products and services provided by third-party parties with simple customizations and drag-and-drop.

The low-code integrated studio has been able to chart a compelling evolution arc:

The entire modernization journey of the Digital Banking Suite has been one of collaboration and partnership—One with a unique goal of providing compelling customer experiences to enable tomorrow’s banking services, today.

It is in fact a well-planned and well-executed transition process that was achieved by combining our client’s co-existence strategy with WaveMaker’s composable platform. WaveMaker’s out-of-the-box components, templates, themes, and underlying architecture were leveraged to deliver differentiated, omnichannel user experiences on the DBS platform rapidly that set in motion the ‘composable approach to software development at NFS.

The future of banking is already here and NFS’s collaboration with WaveMaker has been and will be instrumental in bringing it into reality.

The Digital Banking Suite is one big step in that direction.

Write to us at info@wavemaker.com