Delivering contextual digital banking experiences fast:

The need of the hour for banks

Increased digitalization and the advent of “anytime, anywhere” banking solutions, have led banks to view their digital infrastructure with a new lens. In order to remain significant in the rapidly evolving financial services ecosystem, they need a razor-sharp focus on 3 key aspects:

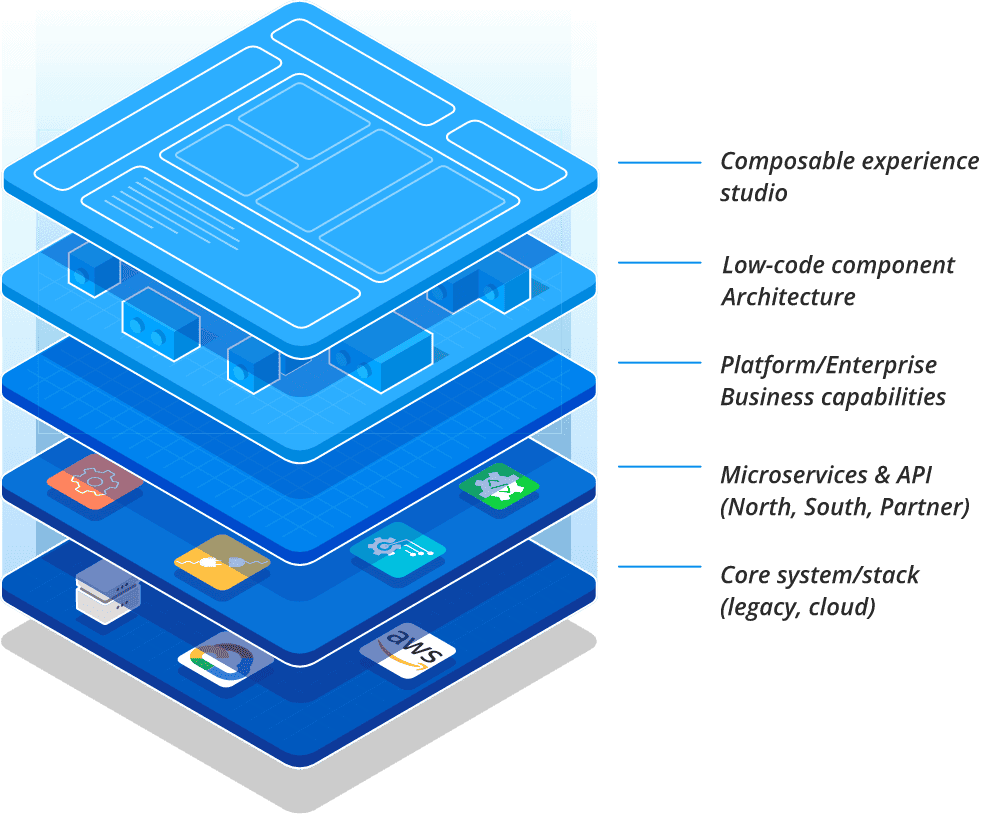

As they adopt “Composable Banking” and start collaborating with niche players, banks need a development platform that can provide the impetus to roll out newer personalized consumer journeys built over internal and external APIs.

Composable Software:

The modern banking tech stack

Break down and componentize all business capabilities with WaveMaker’s prefabs and journeys—custom experience components that can be distributed, customized, and assembled via low-code to compose delightful, multi-channel experiences quickly and at scale.

Build a custom studio, rich with experience components for business developers/citizen developers across your enterprise.

WHAT CAN BANKS DO WITH WAVEMAKER?

THE OPEN LOW-CODE PLATFORM

OF CHOICE FOR ISVS

The only low-code platform which gives you complete control and freedom over your assets.